Credit Score: The Silent Financial Passport You Can’t Ignore

Credit Score related to financial stability, they often focus on income, savings, or investments. But one quiet, often misunderstood number plays a bigger role in shaping your financial future than you might realize—your credit score. It’s not just a number; it’s your financial reputation, your trust score, and in many ways, your silent passport to opportunities. Yet, many people underestimate its true power.

In this article, we’ll go deeper into what a credit score really means, why it matters, how it’s calculated, and some surprising strategies to elevate it. The tone will be practical yet slightly exotic—because financial literacy doesn’t have to be dry. It can be eye-opening, almost like discovering an ancient secret code that unlocks doors in the modern economy.

What Exactly Is a Credit Score?

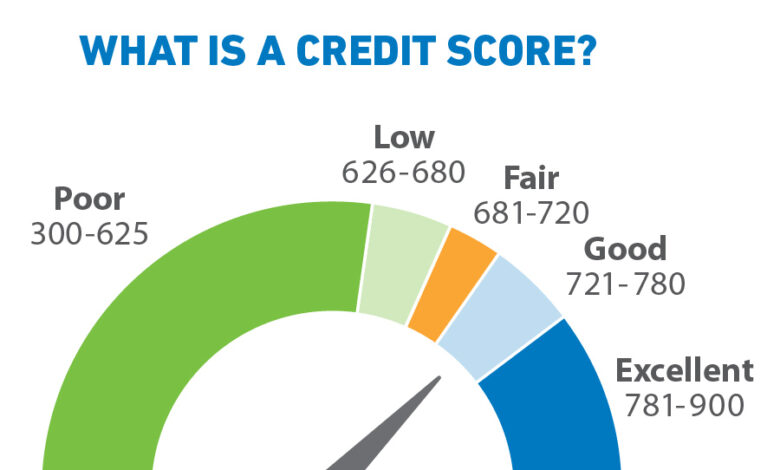

A credit score is often defined as a three-digit number that tells lenders how risky—or safe—it might be to lend you money. That sounds simple enough, but beneath that simplicity lies a complex system of financial behavior tracking, data analysis, and predictive modeling.

Most commonly, scores range from 300 to 850. The higher the number, the better your financial health looks to lenders. But here’s the twist: a credit score is less about who you are and more about how you behave with borrowed money. You could be a millionaire with no loans and still have a weak credit score. Conversely, a modest income earner who uses credit wisely could shine with an excellent score.

Another exotic aspect is how much weight this score carries outside of lending. Some employers, landlords, and even insurance providers take it into account. Imagine applying for your dream apartment or job and being judged by a number that’s not even your salary but how you’ve handled debts in the past. It’s almost like a financial horoscope—your past predicts your future.

And yet, people often discover its significance only when they face rejection: a denied loan, higher interest rates, or difficulty renting a home. By then, the damage is already done. Understanding your score early is like having a secret map before everyone else sees the treasure.

The Anatomy of a Credit Score: How It’s Calculated

A credit score isn’t pulled out of thin air. It’s calculated using key ingredients, each of which reveals something about your financial behavior. The breakdown usually looks like this:

- Payment History (35%) – Do you pay your bills on time? This is the single most critical factor. Even one late payment can leave a stain. Think of it like trust—easy to lose, hard to rebuild.

- Credit Utilization (30%) – This measures how much credit you use compared to how much is available. If you constantly max out your credit card, lenders assume you’re financially stretched, even if you pay it off. Ideally, staying below 30% usage makes you look disciplined.

- Credit History Length (15%) – Lenders like to see consistency. The longer you’ve managed credit responsibly, the more reliable you appear. Closing old accounts can actually hurt you more than keeping them open.

- Credit Mix (10%) – It’s not just about one credit card. Having a blend of installment loans (like a car loan) and revolving credit (like credit cards) shows you can juggle different responsibilities.

- New Credit Inquiries (10%) – Every time you apply for new credit, it leaves a “hard inquiry” on your report. Too many in a short time signals desperation, and lenders don’t like desperate borrowers.

These percentages vary slightly across scoring models, but the principle remains: credit scores are built on patterns of trust, consistency, and responsibility. It’s less about wealth and more about discipline.

Why Credit Scores Matter More Than You Think

At first glance, a credit score may seem like just a tool for banks and lenders. But in reality, it influences nearly every major financial decision in your life. Consider this:

- Loan Approvals and Rates: With a high credit score, you don’t just get approved; you get better interest rates. Over the lifetime of a mortgage or car loan, that could mean saving tens of thousands of dollars.

- Housing Opportunities: Landlords often run credit checks. A poor score could make the difference between getting the keys or facing rejection. Imagine losing your dream apartment not because of money in your bank but because of a low score.

- Insurance Premiums: Some insurers factor in your credit score when calculating premiums. Better score, better rates—it’s almost like being rewarded for responsible habits.

- Employment Checks: Certain industries, especially finance, check credit scores before hiring. It may not feel fair, but employers see it as a measure of responsibility.

A fascinating way to think about it is that your credit score functions like a “silent referee.” You may never see it working, but it quietly determines whether the game plays in your favor.

Myths and Misconceptions About Credit Scores

Credit scores are surrounded by myths that often mislead people into making poor decisions. Let’s untangle a few:

- Myth 1: Checking my score will hurt it.

Not true. Checking your own score is a “soft inquiry” and has no impact. Only hard inquiries from applying for new credit can reduce it. - Myth 2: Income determines my credit score.

Your salary doesn’t matter. It’s your behavior with debt that counts. That’s why someone with a modest income but consistent payments can outperform a high-income earner with bad habits. - Myth 3: Paying off debt erases bad history.

Old mistakes don’t disappear instantly. Negative marks can stay for years, though their impact lessens over time. Think of it as a scar that fades but doesn’t vanish overnight. - Myth 4: You need to carry debt to build credit.

Not at all. Using credit wisely, even if you pay in full every month, still builds your score. Carrying balances unnecessarily only wastes money on interest.

By debunking these myths, we see the truth: credit scores are about responsibility, not wealth, and about patterns, not quick fixes.

Strategies to Boost Your Credit Score

Improving your credit score is not rocket science—it’s more like gardening. You plant good habits, water them with consistency, and watch them grow over time. Here are some effective strategies:

- Always Pay on Time: Even a single missed payment can drag you down. Setting up auto-pay or reminders can keep you safe.

- Keep Utilization Low: If you have a $10,000 credit limit, try to use less than $3,000. Better yet, keep it below 10% for maximum impact.

- Don’t Close Old Accounts: Length of history matters. That old credit card you’ve had since college? Keep it open, even if you rarely use it.

- Limit New Applications: Space out credit applications. Too many in a short period looks like financial instability.

- Dispute Errors: Credit reports can contain mistakes. Regularly checking your report ensures errors don’t unfairly hurt you.

What’s exotic here is realizing how small, almost invisible habits—like paying a bill on time or leaving an old card open—can have long-lasting ripple effects. The credit system rewards patience and consistency, almost like an ancient philosophy that honors discipline over impulsiveness.

The Future of Credit Scoring: Beyond Numbers

Credit scoring isn’t frozen in time. With technology evolving, newer models are emerging that look beyond traditional factors. Some fintech companies and alternative lenders are experimenting with:

- Behavioral Data: Instead of only looking at credit history, they may analyze spending habits, subscription payments, or even how promptly you pay your phone bill.

- AI and Machine Learning Models: These tools might assess your financial behavior in more dynamic ways, potentially making credit scores more personalized.

- Global Credit Systems: As people migrate and work internationally, there’s increasing demand for credit systems that travel with you across borders. Your financial reputation might one day be truly global.

This shift indicates that the rigid, number-based model could evolve into something more fluid and holistic. But for now, the traditional credit score still reigns supreme.

Final Thoughts: Credit Score as Your Financial Mirror

Your credit score is more than just a number; it’s a mirror reflecting your relationship with money. It captures habits, discipline, and decision-making. While it may feel unfair at times—especially when past mistakes haunt you—it’s also empowering. With the right strategies, you can rewrite your financial story.

Think of your credit score as a passport. A strong one allows you to travel freely through the financial world, unlocking opportunities and savings. A weak one keeps doors shut. But the beauty is, unlike actual passports, this one can always be renewed, rebuilt, and strengthened with effort.

In a way, mastering your credit score is like mastering yourself—building discipline, consistency, and foresight. And when you do, opportunities that once seemed distant suddenly become accessible.